by PIDC

March 11, 2025

Categories: Business Tips & Resources,

If you’ve ever felt overwhelmed by the world of credit, you are not alone. Credit isn’t just a number; it’s a key to building a strong financial future. Whether you’re planning to buy a car, secure a business loan, or simply manage your finances more effectively, understanding credit is essential.

March is Credit Education Month, so PIDC is breaking down credit basics so you can unlock economic opportunities and take charge of your financial future.

What is Credit?

Credit is the ability to borrow money or access goods and services with a promise to pay later. When you use credit responsibly, lenders trust you more, making it easier to borrow in the future. It also impacts your ability to secure lower interest rates when you borrow money. That’s because your credit score is one of the measures a lender uses to determine how responsible you are with money. Think of it as a financial report card, the better you are with your finances, the higher your credit score is.

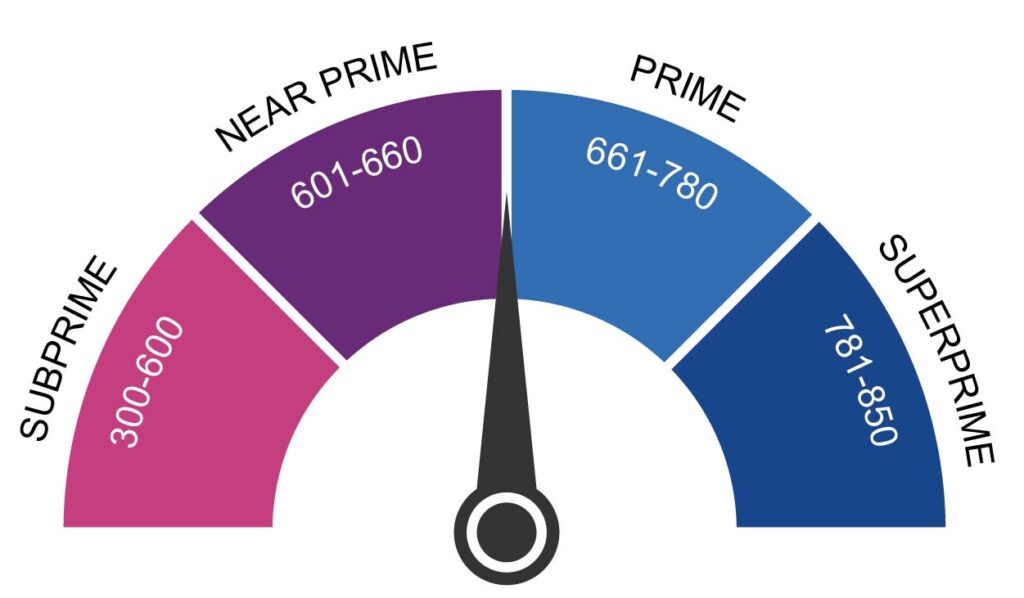

Most organizations rely on one of two credit scoring models, FICO and VantageScore. Here’s a quick overview of the score ranges:

FICO Score Ranges

Vantage Score Ranges

In the majority of cases, lenders rely on your FICO score to evaluate how risky it is to lend you money. But both scores matter, so it’s essential to track each of them. The higher your score, the more likely you are to be offered better financial opportunities, including lower interest rates, higher credit limits, and more favorable loan terms.

How to Improve Your Credit Score

Life is unpredictable and even if you’re trying your best to be financially responsible, things happen. Losing a job, getting into an accident, or major life transitions like starting a family or moving can sometimes force you to overextend financially, which can negatively impact your credit score. So, if you’re looking to improve your credit score, these steps can help:

Pay your bills on time

Your payment history is one of the biggest factors impacting your credit score. A late or missed payment can dramatically decrease your credit score, sometimes by as much as 100+ points depending on how long the bill goes unpaid. Plus, late payments can remain on your credit reports for up to 7 years. You can avoid overdue bills by setting up automatic payments or payment reminders like calendar notifications or payment tracking apps.

If you’re struggling to meet the minimum payment, don’t ignore it. Many major credit issuers offer hardship programs for individuals experiencing temporary financial challenges like job loss or medical expenses. Reach out to your lender to see what assistance they offer.

Limit credit utilization

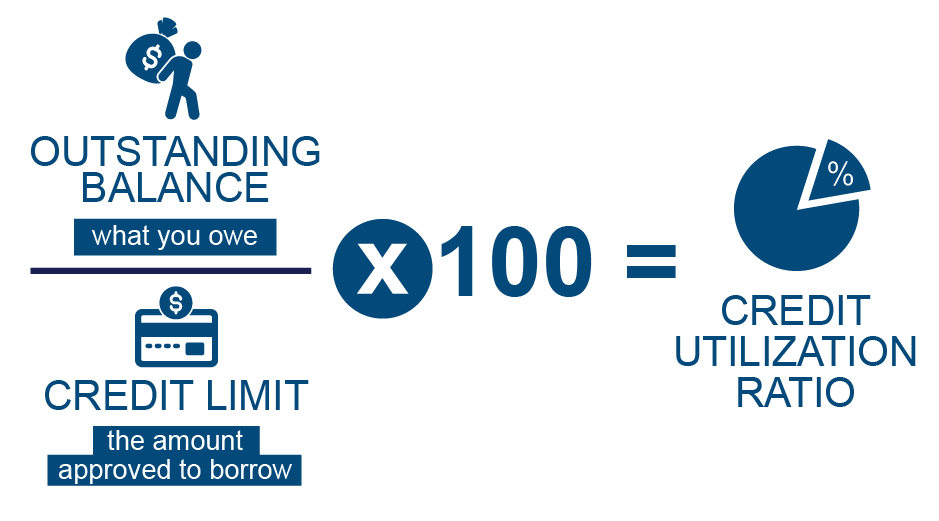

Credit utilization refers to the percentage of your available credit that you are currently using. This percentage is calculated across all of your credit accounts (for example, if you have three credit cards). It is one of the most significant factors in determining your credit score. Conventional wisdom says keep your credit card balance below 30 percent but Marla S. Hamilton, SVP of Client Engagement & Business Support at PIDC recommends keeping utilization even lower.

“The higher your balance is above 30 percent of the credit card limit, the greater chance of your credit score taking a hit and staying in the 500-650 range, “ said Hamilton. “We recommend our clients keep utilization no higher than 20 percent. Ideally you can keep your percentage to zero by paying your credit card balance in full each month.” High utilization may cause your credit score to remain low even when you make timely monthly payments.

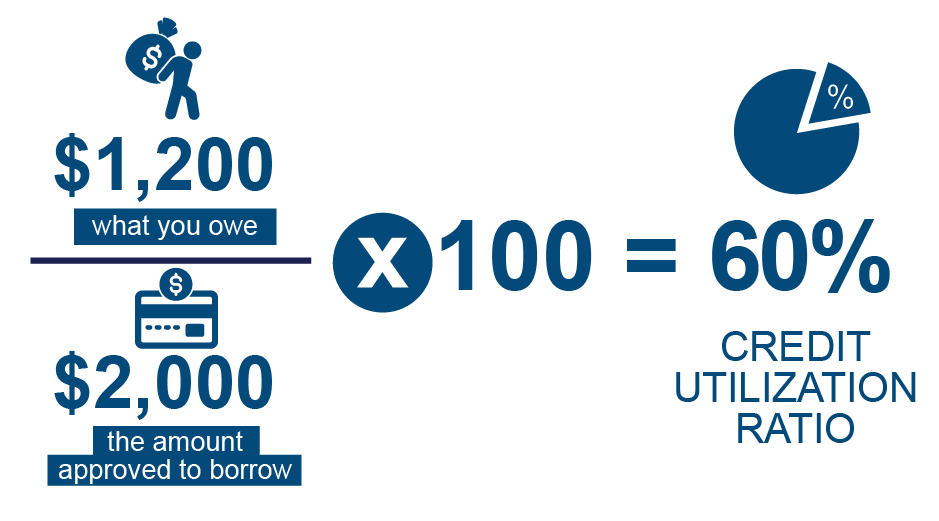

Here’s how to calculate your credit utilization. Simply divide your outstanding balance (the amount you owe) by your credit limit (the total amount you’re approved to borrow) and multiply by 100.

For example, if you have an outstanding balance of $1,200 and a credit limit of $2,000, you can find your credit utilization by dividing 1,200 by 2,000 to get .6. Then, multiply .6 by 100 to get 60. That means your credit utilization is 60%, much higher than the recommend 20%

Track your credit and dispute errors

Your credit score is a living number that changes based on your financial habits. Typically, your score updates about once a month and can rise or fall based on a variety of factors, including payment history, credit use, credit mix, and more. It’s important to track your score, and there are several ways to do so.

Many major banks and credit card companies offer free credit scores through your monthly statement, app, or online account. There are websites that offer credit scores for free, like Credit Karma and Credit Sesame. You can also purchase your credit score through the three nationwide consumer reporting companies: Equifax, Experian, and TransUnion. Federal law requires these agencies to provide a free credit report annually as well, which can be done through AnnualCreditReport.com.

Review your credit report thoroughly. In a recent study from Consumer Reports and WorkMoney, they found that almost half of respondents found at least one error on their credit report. Common errors can include incorrect personal information like wrong names, phone number, or addresses, inaccurate payment information, duplicate debts, outdated accounts, and more. If you find a mistake in your credit report, file a dispute with the credit bureau that issued the report right away. Make sure to provide a clear explanation of the error and include any supporting documentation you have. Disputes are usually reviewed within 30 days.

The Three C’s of Credit

The three C’s of credit are the key factors that lenders use to evaluate your creditworthiness. These three factors are Character, Capacity, and Collateral, and they help assess the risk of lending an individual money. Camille Simpkins, PIDC’s Business Lending Relationship Manager, says understanding the three C’s can help you improve your financial standing and access better credit opportunities.

Character

Think of character as your financial reputation. What is your history of paying your business and personal bills on time? Are you limiting credit utilization? “Character is assessed through the borrower’s credit history, payment patterns, credit references, and credit usage,” said Simpkins. “We want to know if you have a good track record of managing credit responsibly.“

Capacity

Capacity is your ability to repay a loan. It’s based on factors like income, employment status, and existing debt obligations to ensure you can handle additional debt without financial strain. “We assess a borrower’s overall financial stability by calculating their debt-to-income ratio, “ said Simpkins. “You can calculate your own debt-to-income ratio by adding up all your monthly debt payments and dividing them by your gross monthly income.”

Collateral

Do you have sufficient assets to support repayment of a loan in the event of a default? Collateral can include things like savings, business assets, and property, and act as a financial cushion in case a borrower fails to repay their loan as agreed. Lenders can take possession of collateral to recover the outstanding loan amount. The more collateral you have, the lower the risk is for lenders to offer you a loan.

By building a strong track record for repaying debts (Character), keeping your debt-to-income ratio low (Capacity), and increasing your assets (Collateral), you can unlock better loan options and greater financial security.

Can Your Personal Credit Score Affect Your Business?

Your personal credit score is tied to your individual financial history and reflects how responsibly you manage personal debt like credit cards, car loans, and mortgages. Business credit is separate from personal credit and is linked to your business’s Employer Identification Number (EIN) or Tax ID and demonstrates your company’s ability to manage financial obligations like business loans and credit cards.

However, even if your business is a separate legal entity, lenders, landlords, and vendors often check your personal credit score. Some lenders require a personal guarantee, which means that you personally agree to take on responsibility for a loan if your business can’t pay it. Poor personal credit reduces the likelihood that lenders will offer you business loans. This means your personal credit score is critical for your business success, especially if your business is new or lacks a strong credit history.

Take Control of Your Financial Future

Understanding and managing credit is a crucial step toward financial empowerment. By understanding the basics of credit, monitoring your credit score, and adopting responsible financial habits, you can take control of your financial future. With the right tools and strategies, you can set yourself and your business up for success.

Want to learn more about how credit works and how it impacts your financial future? Check out this video on Credit Dynamics, where we break down the essentials of personal and business credit, provide tips to improve your credit score, and teach you how to establish business credit.

Note: The insights in this post have been enriched by contributions from business lending and business support service experts at PIDC. Their knowledge and experience helped shape the content, ensuring the information is accurate and reliable, so you can manage your credit effectively.

Funding You Need to Grow Your Business

PIDC invests flexible, affordable capital in growing companies because we know that local businesses create jobs, build wealth for entrepreneurs, and support neighborhood growth. Let us help your business grow.